The days of measuring an app’s success by downloads and ratings are long behind us. To better guide your mobile app marketing decision-making, we’ve identified a list of mobile marketing metrics that speak to the current state of the mobile app industry.

Read on to build a reporting dashboard capable of measuring whatever the industry throws at you.

Prefer to download this article? Find that here.

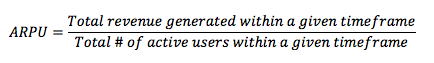

1. Average Revenue per User (ARPU)

Average Revenue Per User is the amount of revenue each of your active customers (on average) contributes.

ARE THERE ANY MEANINGFUL BENCHMARKS?

ARPU varies greatly by app category and revenue model, rendering comparisons rather useless. However, there have been some ballpark estimates for app categories and for various mobile revenue models:

Source: VisionMobile

Apart from the apps with enough value to warrant a subscription fee and the top apps that generate over $50k in revenue per month, ARPU is pretty constant at around $0.04 per active user per month (as of 2022) or $0.48 per active user per year.

WHY DOES IT MATTER?

Once you have calculated your average revenue per user, you can use it in tangent with two of the other mobile marketing metrics listed in this guide to make meaningful inferences about your app’s success:

- Used with Cost Per Loyal User (CPLU), ARPU can be used to optimally budget your mobile marketing dollars and ad spend. As a general rule of thumb, marketing dollars are well spent as long as ARPU is greater than CPLU (that is, as long as your mobile customers generate more revenue than the cost to acquire them).

- Used with Retention, ARPU can be used as a proxy for predicted lifetime value (LTV). If an engaged user generates $0.10 per month and is typically retained for one year, for example, you know that the predicted lifetime value of that person is $1.20.

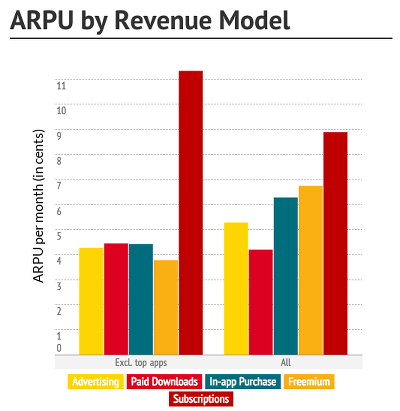

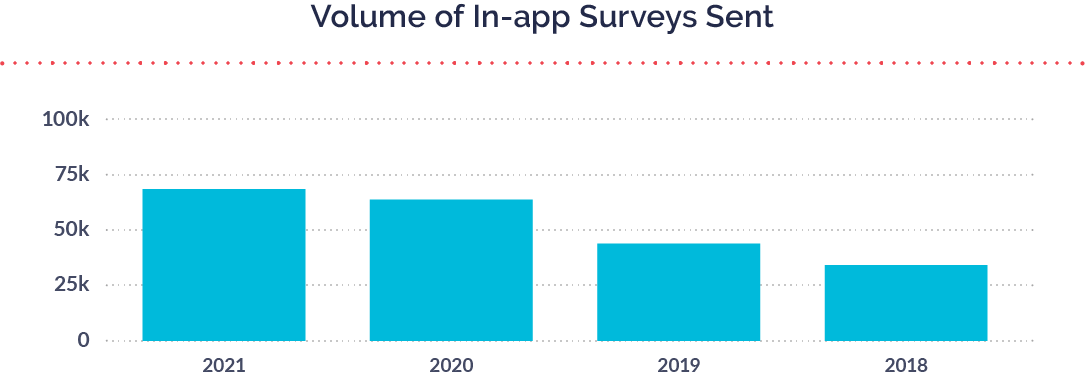

2. Cost per Install (CPI), Cost per Loyal User (CPLU)

The Cost Per Install measures your customer acquisition costs for customers that installed your app in response to seeing an advertisement (tracking paid installs rather than organic installs).

And the derived Cost Per Loyal User metric looks at the cost of acquiring an active user (defined here as anyone who launches your app at least three times).

ARE THERE ANY MEANINGFUL BENCHMARKS?

According to ironSource’s 2021 data, the average US iOS app saw a CPI of $2.37; the average US Android app saw a CPLU of $0.44. However, as was the case with ARPU, this benchmark data should be taken with a grain of salt as both CPI and CPLU vary greatly by app store category and revenue model.

WHY DOES IT MATTER?

As discussed earlier, CPI (and the derived CPLU) is best used in combination with ARPU to calculate the return on investment for your marketing efforts. In order for marketing to make sense, your ARPU must be greater than your CPLU. While this may seem like a no brainer, ad spend is often not justified when it comes to mobile apps – requiring mobile marketers to really know these two metrics.

3. Engagement

Unlike the other mobile marketing metrics listed here, there is no standard definition or formula for Engagement. Engagement can only be defined within the context of the individual app and its mobile marketing strategy.

With that said, engagement is most often talked about in terms of the phenomena associated with wanting to use the mobile app longer and more frequently.

Engagement itself isn’t a metric, but there are several more tangible metrics that fall into the engagement bucket:

- Session length: How much time does a customer typically spend in your app in a single session?

- Session interval: How frequently do customers launch your app?

- App screens per session: How many parts of your app (screens) does a customer launch in a single session?

- Conversion rates for events: What percent of customers complete x action within the app?

- Interactions: What percent of customers are messaged and prompted; what percent of customers respond to a message or prompt?

- Opt-ins: How many customers sign up for additional alerts or notifications?

- Opt-outs: How many customers request fewer alerts or notifications?

ARE THERE ANY MEANINGFUL BENCHMARKS?

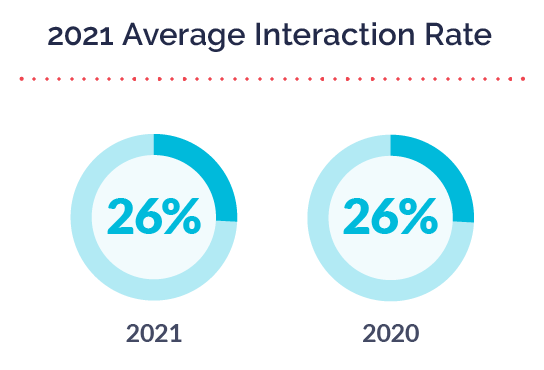

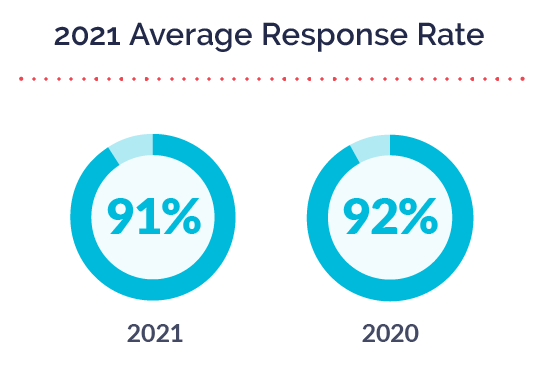

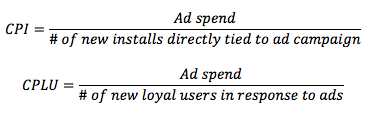

According to Alchemer Mobile (formerly Apptentive)’s 2022 Mobile Customer Engagement Benchmark report, the average app engaged 26% of its customers. Of those who were interacted with, 91% responded to the brand.

There was also a 12% increase in the number of surveys sent from 2020 to 2021. A steady increase that was not as dramatic as it was in 2020.

WHY DOES IT MATTER?

Engaged customers are the bread and butter of your mobile app’s success. Not only are engaged customers likely to bring in more referrals and give your app some love in the form of a glowing app store review, they’re likely to be more loyal and more profitable.

Paired with mobile analytic programs such as Google Analytics, engaged customers can be “cohorted” (segmented and tracked over time) to uncover trends and actionable insights into your customers’ behavior: How does engagement change over time? What actions lead to higher engagement? How long do customers stay engaged?

4. Love Percent

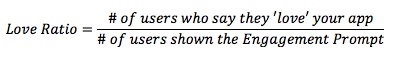

Unique to apps using the Alchemer Mobile (formerly Apptentive) Love Dialog, this metric starts with showing your mobile customers a one-question in-app survey: “Do you love this app?”

Customers have three response options: to say “yes,” to say “no,” or to dismiss the prompt. The Love Ratio is the percentage of customers polled who respond “yes” rather than either of the other two options.

ARE THERE ANY MEANINGFUL BENCHMARKS?

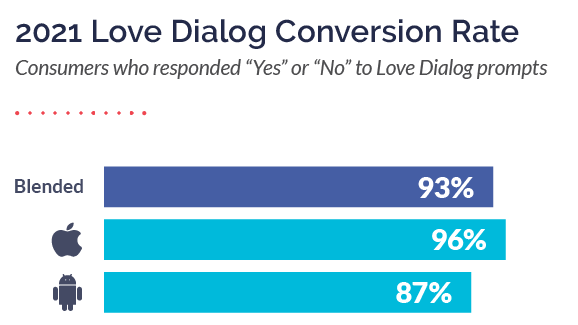

In 2021, 93% of all consumers who were prompted by a Love Dialog responded “Yes” or “No” rather than closing out of the prompt. On iOS, the number was even higher at 96%, compared to 87% of consumers on Android. The Love Dialog garners such high response rates primarily because of its simplicity. People are willing to answer short, simple questions and share feedback when they’re proactively asked for it at the right mobile moment.

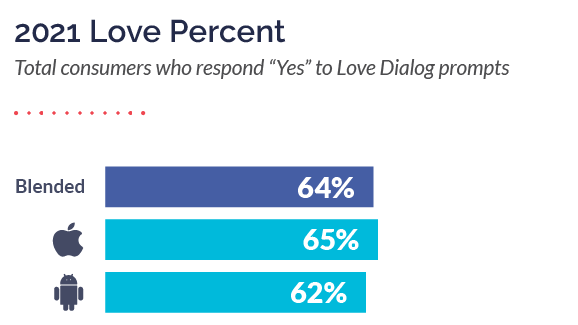

Let’s focus on the people who responded “Yes.” In 2021, 64% of consumers prompted responded that “Yes,” they loved the brand. These quick, positive responses are a great way for brands to take a regular emotional pulse from their consumers, without asking them to leave the app for feedback or take another step away from their intended use of the app. They’re also a much better indicator of consumer happiness and potential lifetime value than lagging metrics like NPS.

WHY DOES IT MATTER?

The Love Percent is the simplest and most accurate way of measuring the overall customer experience. By requiring very minimal work from the prompted customer, this prompt sees virtually no opt-out, allowing you to hear from a large sample of your active customers in a short period of time.

Compare these results to your app store ratings (typically received from less than 0.05% of your customers and biased by those who have an extreme opinion of your app one way or the other—and thus more likely to take the time to fill out a review), and it’s clear that the Love Percent provides a much more representative indicator of your customer experience.

The Love Percent is also a metric that can be tracked over time and over version history to gauge how incremental updates to the app impact the customer’s experience or used as a segmentation tool to message fans and critics in a different manner.

Prefer to download this article? Find that here.

5. Retention

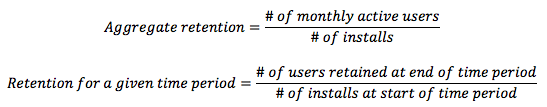

Retention is a measurement of customer churn: How many customers continue to actively use your app after one week? One month? One year?

Again, the calculation of this metric is dependent on your unique app and mobile marketing strategy. Before calculating, you need to set the criteria for what a retained customer looks like. Is it anyone who launched your app in the past 30 days, or someone who uses your app every single day?

ARE THERE ANY MEANINGFUL BENCHMARKS?

How brands define “successful” retention is extremely dependent on the length of time measured. Many mobile teams focus on short-term, 30-day retention as their primary success metric. Fewer focus on 90-day retention, and very few prioritize annual retention. However, you need to look at all three metrics—especially the longer term—in order to understand how retention impacts customer sentiment and your product roadmap.

For 2022, here are the four primary app retention benchmarks to aim for.

WHY DOES IT MATTER?

Knowing your retention gives you a much better indication of your app’s success and current customer-base. Your app might have 100,000 downloads, but how many of these people are actually active?

With continually increasing CPIs and CPLUs, mobile marketers can also save significantly by switching gears from acquisition to retention while driving the same growth. (Read more on the benefits of retention marketing.)

6. Uninstalls, not installs

Traditionally, installs (or downloads, or registrations) have stood out as the chief KPI of any mobile app marketing campaign. Yet, with everything we now know about an app’s retention, usage, and monetization, installs are no longer the be-all, end-all that they were in the early days of the App Store. Let’s say farewell to installs and welcome in a more powerful metric: uninstalls.

At its core, installs are an acquisition metric. The figure tells you how many people have discovered your app and proceeded to download and subsequently install it. It’s a pretty straightforward metric and provides some considerable (albeit assumptive) insights into competitive advantage and sustainability:

- If you have more installs than your competitor, you’re in good shape.

- If you see an upward trend in installs, your app is showing healthy growth.

The only problem? Installs aren’t big-picture. They fail to capture any data on the cost or the value of an install. With more information, the statements above can just as likely produce a negative result.

Your competitor has more active and loyal customers, even though your app has seen more installs. More customers are leaving your app than installing it, making overall customer growth negative even though install growth is positive. Alternatively, you’re paying more to acquire customers in the form of paid advertising than you’re collecting, thereby generating a negative return on your growing installs.

In other words, installs alone don’t provide enough information to make any meaningful analyses.

WHY DOES IT MATTER?

A better metric for indicating an app’s overall sustainability is the antithesis of an install, the uninstall.

While installs are an acquisition metric, uninstalls are a retention metric. They tell you how many of your mobile customers discontinue using your app each week and whether this trend is growing or diminishing. Unlike acquisition metrics, which can be assumptive or downright faulty, retention metrics provide indisputable evidence into the long-term sustainability of your app.

To demonstrate the difference between using installs and uninstalls to assess an app’s health, consider the following scenario:

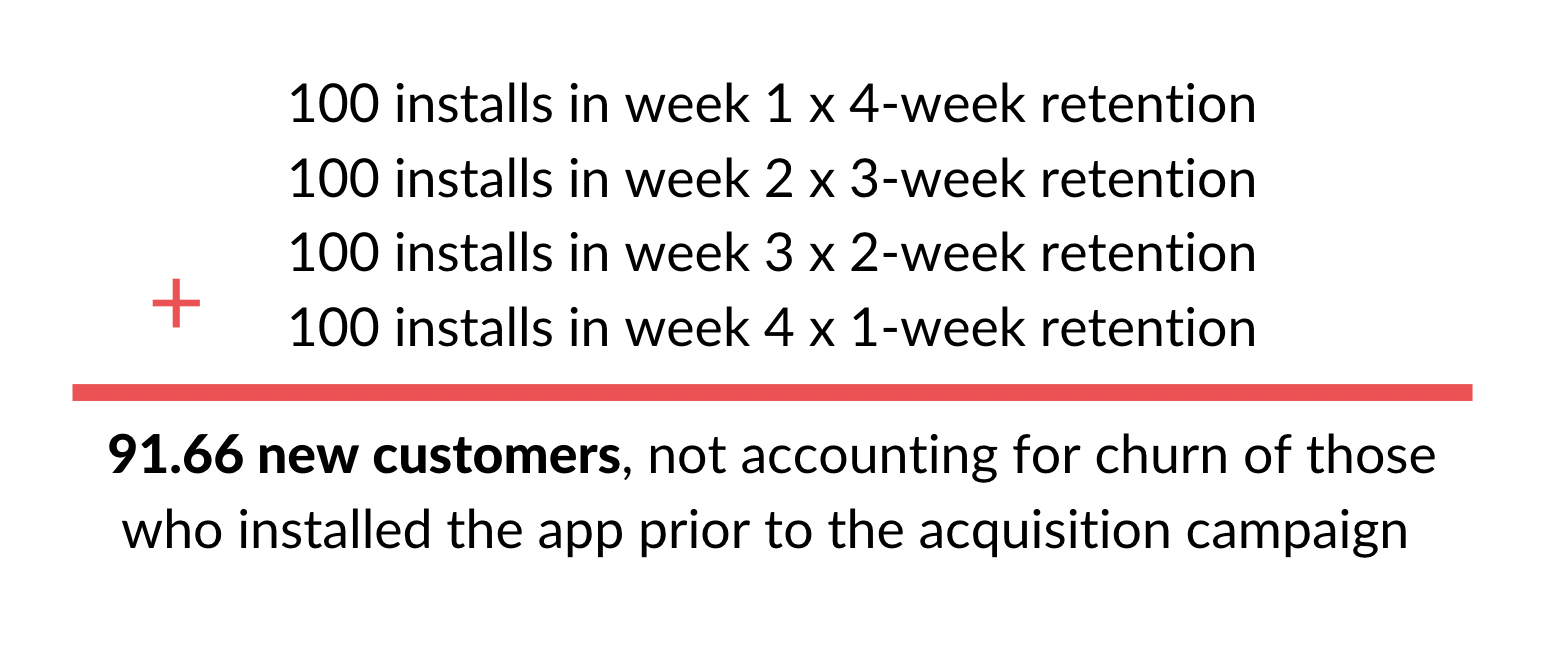

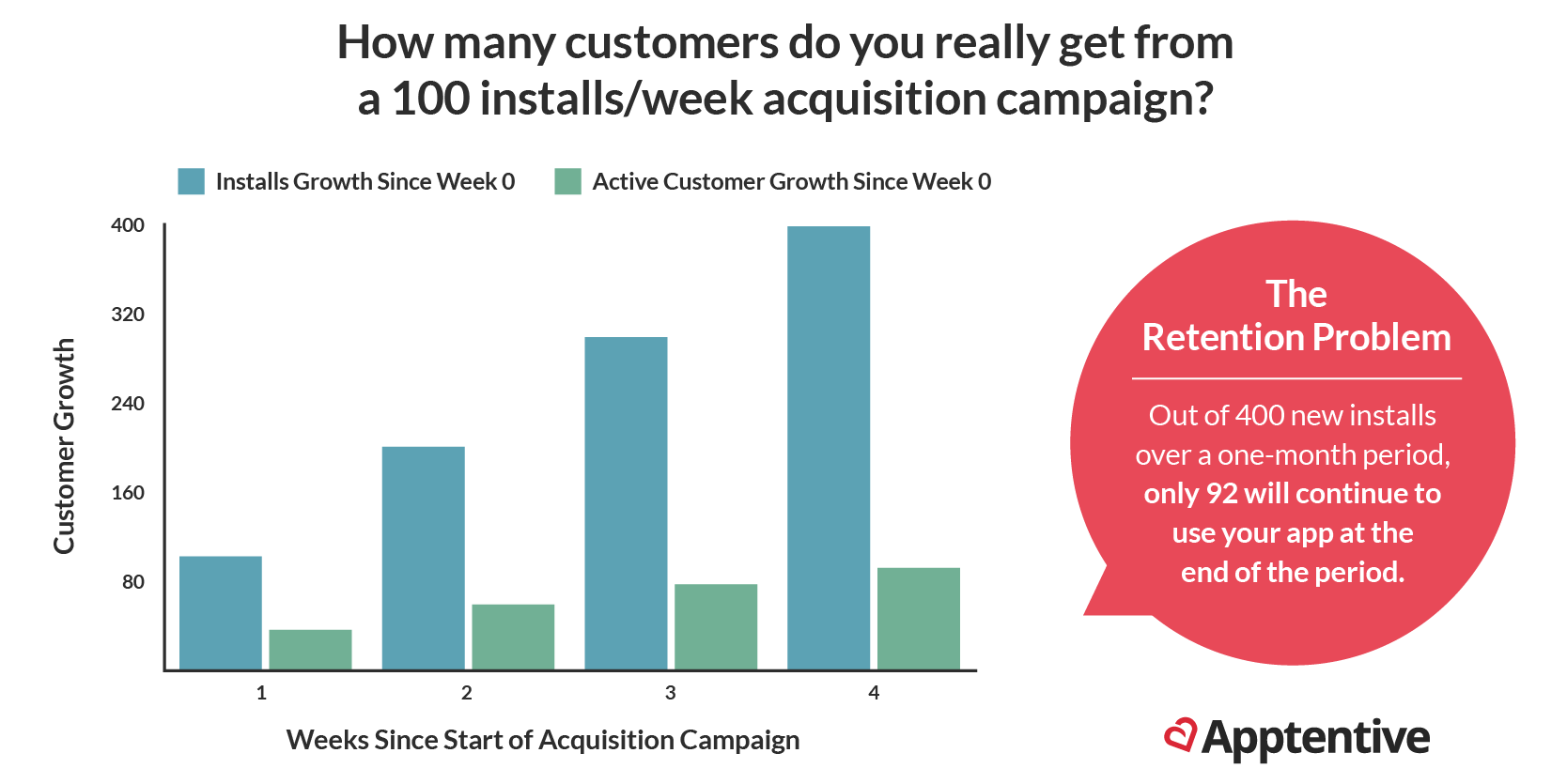

For example’s sake, assume you’ve orchestrated an acquisition campaign, either organic or paid, capable of bringing in 100 new customers a week for one month. From an acquisition perspective, this would be a strong campaign. You would measure a growth of 400 customers at the end of the month (100 installs/week x 4 weeks). Not too shabby.

From a retention perspective, the results look a little bleak. True, you have 400 new installs; but few of those new players will continue to use your app 24 hours after the install, let alone at the end of the four-week period. Instead of the promising 400 new customers measured above, you’d measure 92 new customers by month’s end to account for the dwindling retention rate. The math here is a little more complicated, but it essentially discounts for customer churn at the end of each week:

The result looks like this:

If your acquisition campaign was a paid one, this new uninstall-based ROI measurement carries an even stronger burden: As only one in four customers will continue to use your game at the end of the month, your cost per install is essentially 4x greater if you only intend to measure loyal or profitable installs. Down the line, we’ll see how this factors into our measurement of your return on investment.

With each of our proposed mobile app marketing metrics, it’s important to recognize that app marketing metrics are most effective when used in combination with other metrics. Used alone, uninstalls can’t provide all of the information we need to address the assumptions in install measurement. Namely, they can’t speak to the return on investment of a paid acquisition campaign. However, when used in tandem with other metrics like ROI or LTV, which we cover later, we can address such questions.

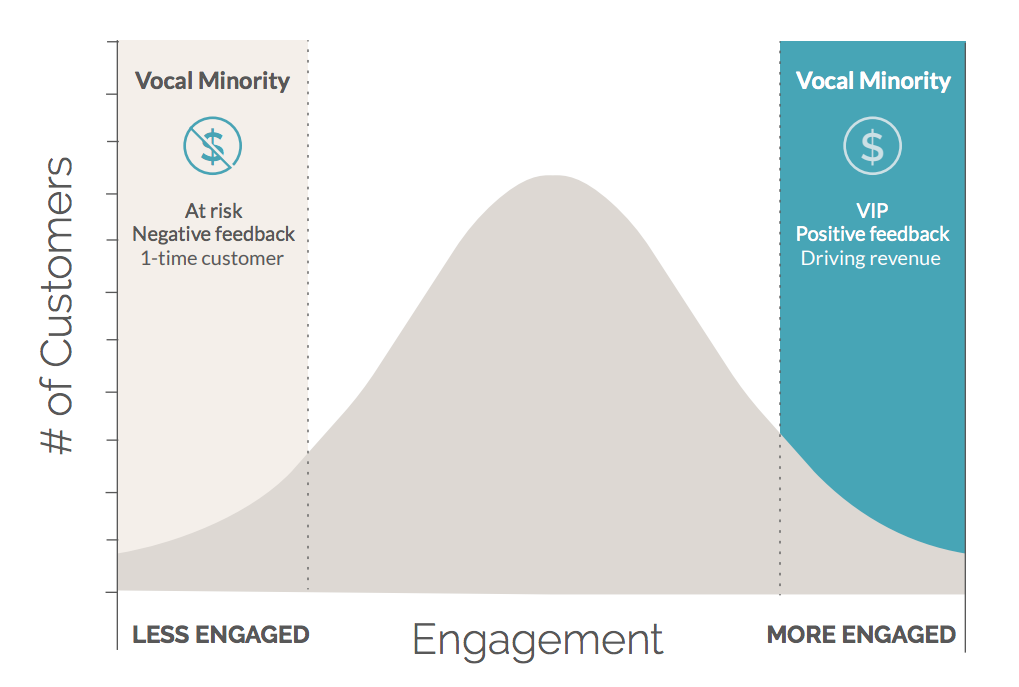

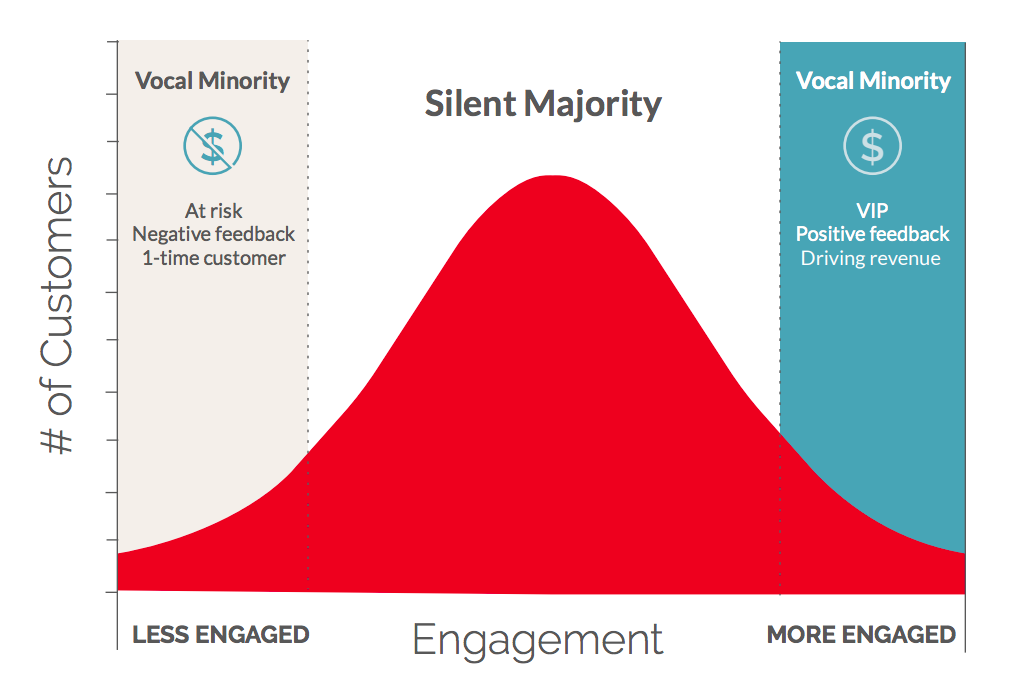

7. The silent majority, not just the vocal minority

Not a metric in and of itself, this next callout involves a range of metrics including the percentage of your mobile customers you’ve engaged/conversed with and the representativeness of your customer insights on your app’s greater audience. Simply, we recommend moving away from the lowest-hanging fruit of the customer insights world (your ratings and reviews, customer service contacts, social media mentions, etc.) and toward a comprehensive understanding of the voice of all customers.

Because many brands struggle to gather customer feedback in proactive, non-intrusive ways, feedback typically comes from the smallest, most vocal group of customers. Many brands today may think they build products around their customers based on feedback from a majority, but they couldn’t be further from the truth. In reality, our data shows that brands only hear from less than 1% of their customer base, which we call the “vocal minority.”

The vocal minority is made of up of two groups of customers: those who are at risk, and those who are VIPs. The at-risk customers have typically had a negative experience with your brand that triggered their feedback—their meal was bad, their flight was delayed, or they ran into an irritating bug in your app. They’ve raised their proverbial hands to alert you of their problem, whether it’s a one-off occurrence or affecting a larger group of your customers. The VIP group’s experience is just the opposite. These are your all-star, loyal customers—the ones who engage in every email, refer you to their friends, interact with you through other digital channels, and who purchase your goods and/or services regularly.

WHY DOES IT MATTER?

There is much to learn from the vocal minority of at-risk and VIP customers. The vocal minority has a lot to say, and product professionals and marketers must listen to the group’s feedback and respond to it (and act on it!) accordingly. But remember, the vocal minority makes up ~1% of the average brand’s customer base. The most dangerous decision a brand can make is acting on feedback that doesn’t accurately represent the majority of its customers.

To hear from more of your customer base and collect meaningful decision-driving information, what’s a brand to do? You must shift your priorities and the way you ask for feedback to unlock the “silent majority” of your customers.

The silent majority is made up of roughly 99% of your customers who don’t fall into the vocal minority. These customers span across a broad spectrum of sentiment, but they tend to fall somewhere in the middle of loving your brand and being at risk for churn. The vast majority of your customers fall into the silent majority, and typically, their feedback and loyalty aren’t being fostered or prioritized.

Your next step is crossing the hurdle of getting the silent majority to provide feedback. Fortunately, customers expect you to ask them for feedback directly. Our research shows 51% of consumers expect companies to ask for their feedback across all channels (email, phone, in-store, online, in-app), and that number is even higher for consumers who prefer to leave in-app feedback (64%). What’s even better is that app customers are very willing to give feedback: 98% of our respondents said they will likely give feedback when asked. The key is to be proactive in asking for their feedback rather than waiting for them to raise their hands, and to ask at the right moment within your digital experience in order to give conversations the best opportunity to begin.

8. Criticism, not adoration

Less of a question of metrics and more of a shift in priorities, this next tip deals with the mentality that so many of us have around one-star and five-star reviews. We all love five-star reviews. They serve as self-validation, social proof, and a reminder of the loyal audience you’ve fostered. When a one-star review comes around, things are different. We feel disheartened and don’t give the review the time of day. We’re left refreshing our screens, just waiting for a new five-star review to push down that stain on our app’s reputation.

Yet, in 2022, this mentality has never been more dangerous to the process of continuous innovation an app needs to stay relevant in the eyes of its customers.

WHY DOES IT MATTER?

There’s a reason five-star reviews fill us with a warm and fuzzy feeling. They tell us exactly what we want to hear.

For app publishers, however, there’s a big difference between hearing what we want to hear and hearing what we need to hear. Five-star reviews indicate that our app is right on track. Perfect as is. No changes needed.

Yet, the app stores are no place for stagnation. Even the top 100 apps average one update per month to maintain their prominent ranks and new market entrants are constantly embracing mobile and vying for share of a saturated market.

Five-star reviews trick us into thinking that there’s no more to be done; but just as soon as we come to believe this, a competing app is bound to show that there is more to be done in the ultra-competitive world of the app stores.

As our own Robi Ganguly told Forbes, “Negative reviews are the holy grail of customer feedback.”

A negative review means more than a single dissatisfied customer. What so many app publishers don’t realize is that negative feedback, of any sort, is incredibly rare—and not because their apps are just that great. The reality is that the average company only hears from one out of every 27 unhappy customers. That means that for every one negative review, 26 other customers will simply stop using your app without providing any indication why. So while no one likes to read criticism, that one review may just be the gift you need to improve your app and improve the experience for not only that one customer, but everyone who shares their thoughts in silence.

In addition to providing invaluable suggestions and feedback to guide your product roadmap and next app update, one-star reviews provide you with an opportunity to engage customers one-on-one and win them back. According to our joint report with SurveyMonkey, 55% of customers who leave feedback indicated that they are unlikely to remain customers if their feedback goes seemingly ignored. An additional Lee Resources survey found that 70 percent will do business with you again if you resolve their complaint.

So next time you see a one-star review, we urge you to think of it not as a stain on your app’s reputation, but as a gift—a gift of improved retention, revenue, and product quality. That is, if you know what to do with it.

Want to download this article? Find that here.

9. Message quality, not quantity

Often, app marketing is measured in actions: In push notifications sent, customers messaged, or rating prompts shown. As a result, we’re surrounded by brand communication, to the point where we’re exposed to 5,000 ads each and every day. But as marketers ramp up their communication, they’re greeted with marginally worse results (fewer clickthroughs, more app exits, etc.). They enter into a vicious cycle of increasing their messaging volume to make up for the poor results, all the while the customer is inundated with an app that now looks like Times Square. App publishers will recognize the need to move away from such volume-based mobile app marketing metrics, and focus instead on the quality of their messaging.

WHY DOES IT MATTER?

There’s a reason push notifications and other forms of brand communication are becoming increasingly less effective. Customers are bombarded.

In order to deliver the intended results, your communication must break through the clutter. It must be relevant, respectful, and most importantly, valuable in the eyes of the recipient.

Delivering value-packed messages is less a matter of which vehicle you use for communication and more about how you use it. Whether it’s a push, an in-app message, or an email campaign, approach it through the lens of the customer: How will this add value to their experience?

At Alchemer Mobile (formerly Apptentive), we’ve pioneered a framework and set of related tools for a better way to communicate with your mobile customers communication—one that breaks through the clutter and adds value. This comes down to two things:

- Personalization: Is the message relevant to the recipient? Is it unique to their individual wants and needs? Does it enhance their relationship with your app?

- Contextualization: Will your message make sense at the time and place it is delivered? Is it tied to the customer’s journey with your app?

Push and other forms of communication will become less of a general announcement and more of a personal conversation. And the publishers that move in this direction will find that messaging can, once again, be used to drive retention and engagement.

Put these mobile marketing metrics to work

Understanding the most important mobile marketing metrics gives you control over five incredibly powerful levers for increasing your app revenue. You can now:

- Increase revenue by providing more value to each customer, thereby increasing the ARPU.

- Increase profits by decreasing Cost Per Loyal User by designing more targeted and more effective marketing campaigns.

- Increase revenue by engaging more customers, thereby increasing your monthly active users.

- Increase revenue by creating an app customers love, with a higher Love Percent for each update.

- Increase profits by designing your marketing strategies around retention instead of acquisition, and use your retention as a trust signal around how well your brand knows its customers.

If you want to see how Alchemer Mobile (formerly Apptentive) can help you track and act on these metrics, request an Alchemer Mobile (formerly Apptentive) demo today.